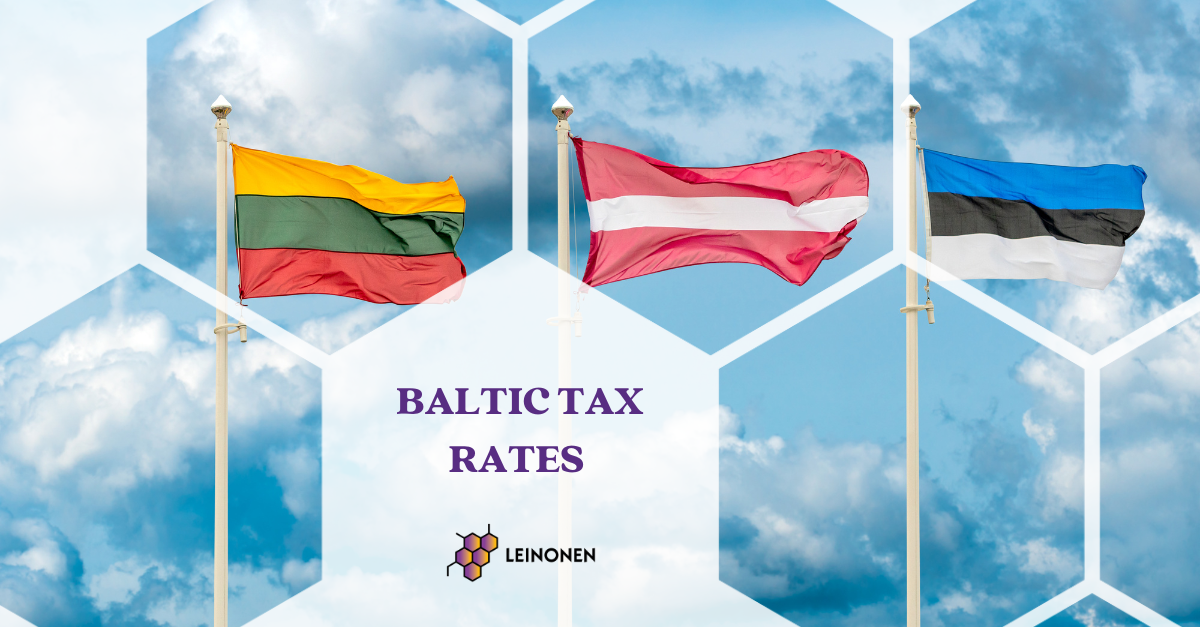

| Estonia | Latvia | Lithuania | |

|---|---|---|---|

| Corporate income tax (CIT) rate | CIT is payable upon profit distributions (the deemed profit distribution). CIT rate is 22%, calculated as 22/78 from taxable net payment. | CIT is payable upon profit distributions (the deemed profit distribution). CIT rate is 20%, calculated as 20/80 from taxable net payment. New optional regime for CIT payers: companies with only individual shareholders may opt for a 15% CIT and 6% PIT on dividends | CIT is calculated as follows: Total income – non-taxable income – allowed deductions – limited deductions = taxable profit. Standard CIT rate is 17% – starting 2026 year tax period (starting 2025 it was 16%). 22% CIT rate is applicable to credit institutions (in 2025 year was 21%). 0% and 7% rates may be applied under certain conditions. 2 |

| Withholding tax rates | |||

| Dividends | 22% calculated as 22/78 from taxable net payment. | 0% or 20% | 0% or 17%, reduced rates may be applied according to Double Treaty Taxation (DTT) |

| Interest | 22% to residents or N/A for non-residents | 0% or 20% | 0% or 10% |

| Royalties | 22% to residents, 10% to non-residents or N/A, in case the exemption applies | 0% or 20% | 0% or 10% |

| Management/ consulting fee | 22%, exemption may be applied according to DTT | 20%, exemption may be applied according to DTT | N/A |

| Alienation of immovable property | 22% | 3% | 17% |

| Rent/lease of real estate income | 22% | 5% | 17% |

| Service fees payable to non-residents from non-cooperative tax jurisdictions | 22% | 20% | Payments made by a Lithuanian company for services to foreign companies registered or otherwise organized in target territories are considered to be non-allowable deductions where the paying Lithuanian company does not supply to the local tax administrator evidence that: 1) such payments are related to the usual activities of the paying and receiving entity; 2) the receiving foreign entity controls the assets needed to perform such usual activities; 3) there is a link between the payment and the economically feasible operation. |

| Wage taxes | |||

| Minimum monthly salary | EUR 886 | EUR 780 | EUR 1153 |

| PIT rates | 22%; Monthly basic exemption – EUR 700.1 | 25,5% rate on annual income up to EUR 105,300; 33% rate on annual income exceeding EUR 105,300 3% additional tax rate for income exceeding EUR 200 000 per year. | 20% rate on annual income that does not exceed 36 average wages;25% rate on annual income from 36 to 60 average wages;32% rate on annual income exceeds 60 average wages. |

| Social security tax rates | |||

| Employee rate | 1.6% unemployment insurance premium; 2% funded pension contribution (if the person has joined 2nd pillar and if higher 4% or 6% is not applied). | 10.50% | Employee’s social security contributions – 19,5%, Participation of employee in pension scheme (optional) – 3%. |

| Employer rate | 33% social tax (the minimum monthly obligation for social tax is EUR 886, it means, for an employer, the minimum obligation for social tax is EUR 292,38 monthly); 0.8% unemployment insurance premium. | 23.59% | Permanent agreement – 1.77%;Temporary agreement -2.49 %. |

| Solidarity tax | N/A | 33 % from income exceeding EUR 105,300 | N/A |

| Security Contributions | 10% rate for non-life insurance contracts. Insurance companies operating in Lithuania will have to calculate and pay the tax. 3 | ||

| Value added tax | |||

| Value added tax rates | 24%, 13% (accommodation) and 9% (journal publications) | 21%, 12% and 5% | 0%, 5%, 12% and 21% 4 |

| VAT registration thresholds | EUR 40,000 | EUR 50,000 | EUR 45,000 |

| Annual EU distance selling threshold | EUR 10,000 for the sales all around EU | ||

| Intrastat reporting | |||

| Arrivals | not applicable | EUR 380 000 | EUR 600 000 |

| Dispatches | EUR 325 000 | EUR 220 000 | EUR 400 000 |

1 In Estonia, tax‑free income no longer depends on a person’s earnings and does not decrease as income increases.

2 Newly registered companies can apply 0% CIT rate not only in the first, but also in the second tax period (there is no longer a condition regarding the number of employees). 7% rate is applicable small entities if the units whose income for the tax period does not exceed EUR 300 000 and which do not meet the conditions according to Law on CIT Article 5, Part 3.

From 2025 according to article 30-2 of the Law on CIT the limitations will also be imposed on the deductibility of the purchase price and rental costs of cars. The new deduction regime will refer to the CO2 emissions of the car. Article 12(6) of the Law on CIT will also be repealed and the income of healthcare institutions for services financed by the PSDF will be classified as taxable income.

3 The exemption applies to contributions for compulsory drivers’ civil liability insurance contracts concluded with individuals for vehicles that are not used for economic activity.

4 The preferential 9% VAT rate for heating, firewood, hot water is abolished, and the preferential 9% VAT rate is increased to 12%: for accommodation services, passenger transport, visiting art and cultural institutions and events.