Often when wage and salary statistics are introduced gross amounts are considered. It also is an established metric when talking about salaries in cross border business environment. But is it really a comparable metric? What does gross salary really tell us?

What Gross Salary is?

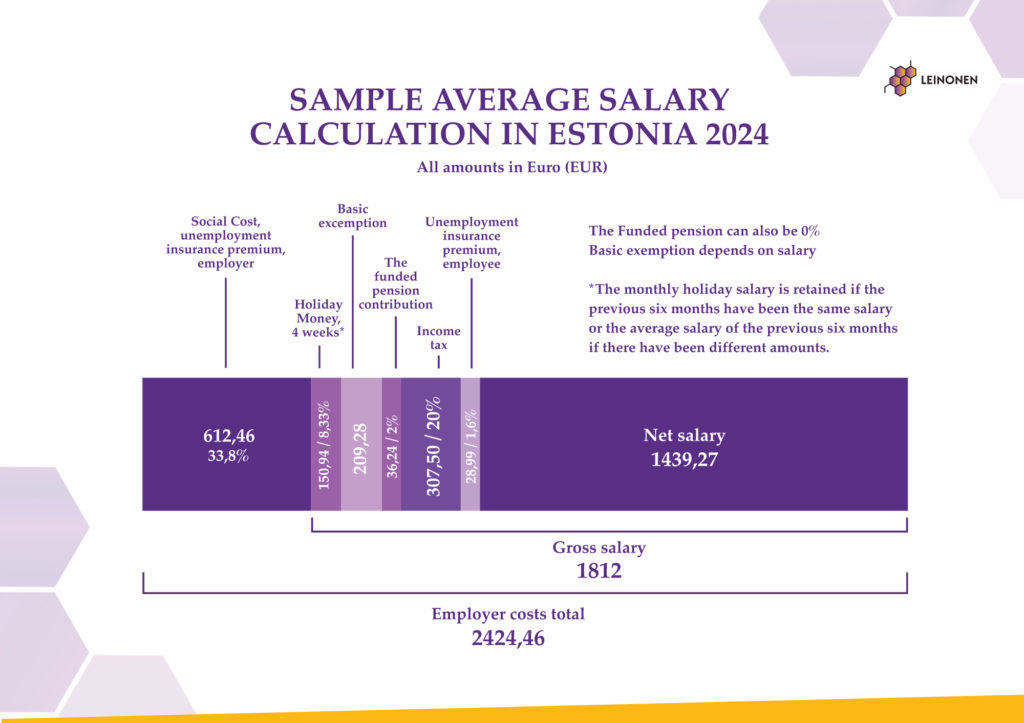

To start with, let’s define what gross income means based on the Eurostat Glossary. If we take the total cost of an employee’s salary it would consist of the employer’s and employee’s tax burden along with social contributions and the amount employee receives as the net income. So, in practice, gross salary is the sum of employee’s net pay, taxes and social contributions. Meaning that social contributions paid by employer are not included and that’s where the core of the comparability problems starts to show.

Now what if the government shifts all or part of its employer’s social security costs to employees. That would increase the gross salary of an employee, but not affect his net pay or affect the amount of taxes paid. So, the employer pays the same cost in total, the government gets the same amount of taxes (employee + employer), and the employee gets the same net pay. Seemingly no change, but there is a significant increase in gross salary. A comparable and illustrative example of a country that shifted most of its employer’s social security contributions to employees is Lithuania. They have done this labor taxation reform in 2019, you can read more on our news covering this change or find a brief overview in the OECD Library.

A practical example of how gross salary compares

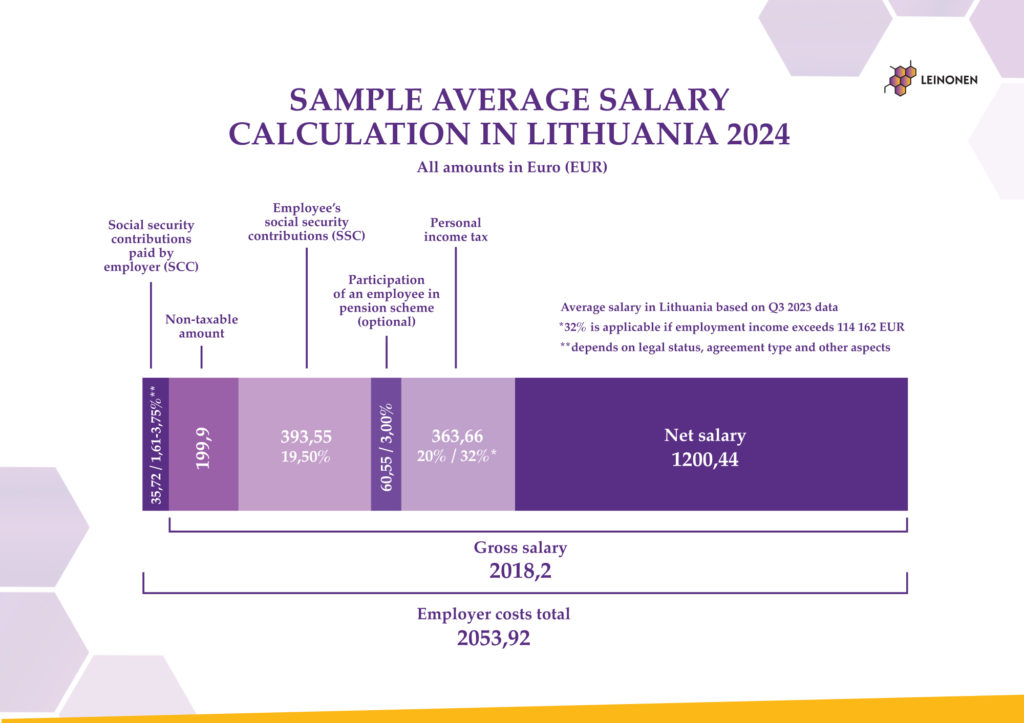

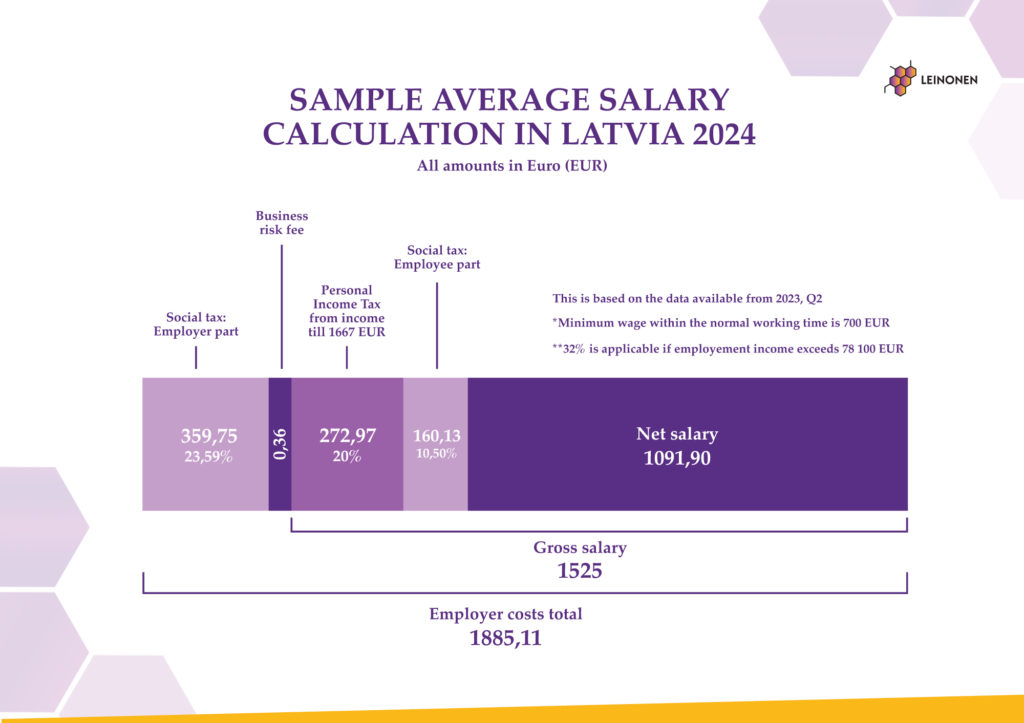

To see how Lithuania compares with other countries let’s take the Baltic region as an example and compare how the total cost of employment breaks down.

As you can see comparing gross salaries in this region would not bring us an understanding of what an employee’s net pay is and/or total cost of employment for the employer. While we bring the example of the Baltics, it applies to all countries and regions in the EU and beyond. The extant might be bigger or smaller, but the idea stays the same.

Why is it important to acknowledge the difference?

We have already explored the statistical effect that such a change has, and this could be crucially important to consider when making decisions based on such data. As an employer, when comparing the cost of employing in your cross-border business or planning business expansion abroad you need to consider the total cost of employment not just gross salary. As an employee, when choosing to move abroad be sure to understand that a higher gross salary does not always mean higher net income.

If you are running a cross-border business, you will also find the gross salary comparability issue worth considering in decisions on the remuneration of your employees. For example, you might decide to introduce a bonus system for your sales resources that would pay 5% of the sales they make in the Baltics. If you simply translate it into gross income, roll out the model saying that 5% of all sales are going to be gross income for the sales manager. Then you will have a significant difference in return on such investment, as in Estonia you would have to add a bit below 34% of the employer’s social contributions as a cost, while in Lithuania only 2%. So, in Estonia, this would mean the actual cost of almost 6,7% from sales, while in Lithuania stays at the same level of 5%.

In summary, while gross salary is a common metric in salary discussions, it can be misleading due to differences in taxation and social contributions across borders. Employers and employees alike must consider the total cost of employment and actual net income for accurate financial planning. Understanding these nuances is crucial in cross-border business to ensure informed decision-making and equitable compensation strategies.

In case of any questions, feel free to consult with Leinonen team. Further contact details can be found HERE. Stay informed about our latest news by following Leinonen on LinkedIn.