The second news about changes in Finnish Accounting Legislation is about new demands for small and micro firms.

Finnish bookkeeping act reform allows small- and micro entities to publish their balance sheet and profit and loss accounts as shorter versions. EU directive 2013/34 has especially placed demands, that demands for micro entity bookkeeping should be lowered. These demands have been applied to the reformed Finnish bookkeeping act.

In future, small- and micro entity bookkeeping demands are as follows:

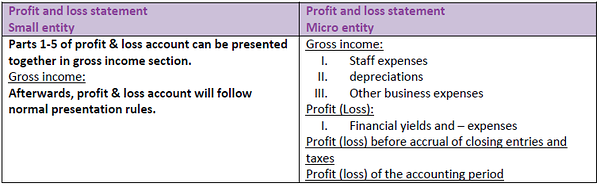

Profit and loss statement:

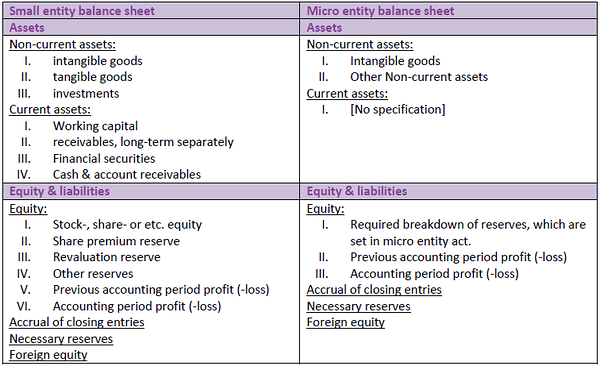

Balance sheet:

The changes brought by the EU directive, give micro entities the possibility to present their financial information on much looser form than small entities. However, the information provided here is rather limited, thus micro entities are required to give additional information, if necessary, to ensure that true and fair view of the companies’ financial situation is achieved.