News

Hoping for the best, preparing for the worst – a business guide to surviving the corona pandemic

A healthy economy is the lifeblood of a nation, but in a situation where borders are closed, events cancelled and socialising heavily curbed, many industries…

Reduction of number of employees and collective redundancy

In regard to the spread of Covid-19, on 13 March 2020, an emergency situation was announced in the Republic of Latvia effective until 14 April…

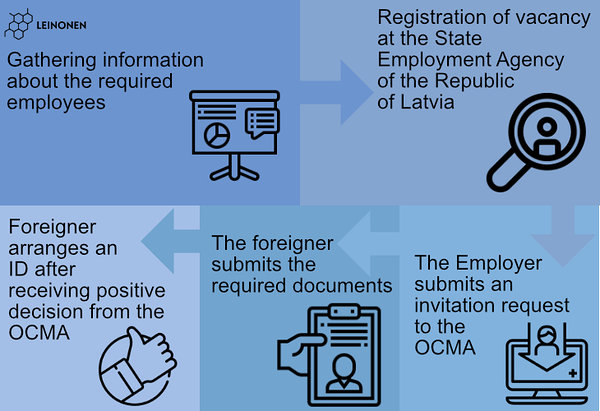

Employment of foreigners in Latvia

The article reflects the most significant steps to be taken, as well as explains the process of obtaining a temporary residence permit for foreigners in…

Withholding tax on transactions with non-residents

In transactions with non-resident legal persons it is necessary to ascertain whether the remuneration of the transaction is subject to the withholding of the corporate…

Tax news January 2020

VAT Law On 1 January 2020, amendments to the VAT Law become effective. Delivery of goods to a warehouse in the EU Member State. Value…

Termination of Employment Relations if the Employee Lacks Adequate Occupational Competence for Performance of the Contracted Work

It is permitted to terminate employment contract only in the cases and in accordance with the procedure determined in the Labour Law. If the employee…

What does termination of company’s activity by the Register of Enterprises means?

Pursuant to the Law on the Prevention of Money Laundering and Terrorism and Proliferation Financing the Register of Enterprises of Republic of Latvia (hereinafter –…

Termination of Employment Relations in the Event of a Significant Violation Committed by an Employee

Termination of employment relations is permitted only on the grounds and in accordance with the procedure as determined in the Labour Law. One of such…

Why should my business outsource accounting services?

Being a business owner or a manager for your company can sometimes mean you are the one keeping an eye on everything. Being responsible for…