Businesses often face situations when some State aid mechanism (grant, loan, financial security, support and area payment, etc.) is refused because the company is recognized as an undertaking in difficulty (UiD) during the particular assessment period. While questions about requests for various types of State aid became more topical during the crisis caused by the COVID-19 pandemic and the overall economic downturn, UiD criteria is used to assess eligibility for several types of aid, which is also relevant during the company’s growth and development.

Reasons for refusing State aid are most often related to the financial position of the applicant itself. This time, we will examine one of the assessment criteria—a UiD company, which is so important that, whenever present, it will render the decision negative.

Table of Contents:

State aid in general

The type, amount and assessment criteria of State aid depend on the objective of the specific aid measure, which is defined by a particular Cabinet regulation, and on the applicable EC regulatory framework. A UiD test is necessary, e. g. when applying for aid provided by public institutions like:

- Central Finance and Contracting Agency of the Republic of Latvia (CFCA);

- State Revenue Service of the Republic of Latvia;

- Investment and Development Agency of Latvia

- Latvian Development Finance Institution ALTUM;

- Rural Support Service of the Republic of Latvia.

Classification of companies

Before scrutinizing the UiD definition, let us first study the company classification criteria established in Article 3, Annex I to the Commission Regulation (EU) No 651/2014 of 17 June 2014 (Regulation 651/2014), which shows that any potential applicant for State aid can be classified as follows:

- an autonomous enterprise—an enterprise that is completely independent or it has one or several partner enterprises (holding < 25% of capital or voting rights of another enterprise);

- partner enterprise—partnership with other enterprises is between 25–50%;

- linked enterprise—partnership with other enterprises exceeds the threshold of 50% (in addition, linked companies outside the Republic of Latvia and enterprises linked through natural persons must be taken into consideration).

The author would like to point out that these definitions are concise and reduced to their essence to present them in concentrated and easy-to-understand form. To learn the exact definition and classification criteria, look up the information provided on CFCA website and in Article 3, Annex I to Regulation 651/2014.

UiD definition and assessment criteria

An undertaking in difficulty is an undertaking in respect of which at least one of the circumstances specified in Article 2, Clause 18 of Regulation 651/2014 occurs. These circumstances can be broadly classified into four groups:

- Sign No. 1—Insolvency or insolvency proceedings. This means:

○ either insolvency has been declared or insolvency proceedings has been initiated, or legal protection proceedings or extrajudicial legal protection proceedings has been initiated or implemented in respect to a beneficiary;

○ bankruptcy procedure has been commenced, amicable settlement or reorganization has been applied;

○ economic activity has been suspended or terminated, or an applicant fulfills the criteria established in regulatory enactments (see Section 57 of the Insolvency Law of the Republic of Latvia) for being placed in insolvency proceedings at the request of creditors.

- Sign No. 2—Rescue aid or restructuring plan.

○ An applicant has received rescue aid and has not yet reimbursed the loan or has terminated the guarantee, or has received restructuring aid and is still subject to a restructuring plan.

- Sign No. 3—More than half of the subscribed share capital has disappeared according to balance sheet (in the case of a limited liability company, joint-stock company, general partnership, limited liability partnership).

An applicant and / or its group of linked companies, according to data of the last financial report and / or operational report (used only to prove prevention of UiD signs), has lost more than 50% of its subscribed share capital (including share premiums).

The author thinks that it should be added here that such is the case when the balance sheet liability item “Total equity” is less than half of the sum of the balance sheet liability items “Stock or share capital (fixed capital)” and “Stock (share) issue premium”.

Thus, the calculation is quite simple: the balance sheet liability items “Stock or share capital (fixed capital)” and “Stock (share) issue premium” must be added up and divided by two. If equity is less than the acquired result, it is a signal of a UiD. And there is no need to make calculations for companies with negative equity as such companies are automatically classified as UiD. Example:

| Not UiD | Not UiD | UiD | UiD | ||

| Equity capital: | |||||

| 1 | Stock or share capital (fixed capital) | 10 000 | 10 000 | 10 000 | 10 000 |

| 2 | Stock (share) issue premium | 5 000 | 5 000 | 5 000 | 5 000 |

| 3 | Long-term investment revaluation reserve | 2 000 | 2 000 | 2 000 | 2 000 |

| 4 | Fair value reserve of financial instruments | 0 | 0 | 0 | 0 |

| 5 | Total reserves | 745 | 745 | 745 | 745 |

| 6 | Retained profit or loss brought forward from previous years | 25 000 | 25 000 | 25 000 | 25 000 |

| 7 | Profit or losses for the reporting year | 1 500 | -35 000 | -40 000 | -45 000 |

TOTAL EQUITY | 44 245 | 7 500 | 2 745 | -2 555 | |

| CALCULATION: | |||||

| Stock or share capital (fixed capital) + Stock (share) issue premium | 15 000 | 15 000 | 15 000 | 15 000 | |

| 1/2 of the fixed capital of equity and stock (share) issue premium | 7 500 | 7 500 | 7 500 | 7 500 | |

| Is equity less than EUR 7,500? | No | No | Yes | Yes |

- Sign No. 4—Additional criteria for large enterprises.

The ratio of debt obligations to equity balance sheet value, according to data of the last two financial reports of an applicant and / or its group of linked companies, exceeds 7.5 (first condition) and the interest coverage ratio is below 1.0 (second condition).

This UiD signal is only checked if an applicant is not a micro, small or medium-sized enterprise (SME) in the understanding of Article 2, Annex I to Regulation 651/2014 and meets the criteria of a large enterprise (i.e. there are minimum 250 employees at the group of companies and the annual turnover is above EUR 50 million and / or the balance sheet total is more than EUR 43 million).

The first condition is calculated as follows: balance sheet liability item “Total creditors” must be divided by the balance sheet liability item “Total equity”. The UiD signal shall be assessed if the result is negative or more than 7.5.

Calculation of the second condition: EBITDA divided by profit or loss account (PLA) item “Interest payments and similar costs”, where EBITDA is the company’s earnings before interest, tax, depreciation and amortization.

EBITDA formula (PLA items): gross profit or loss – sale costs – administrative costs + other revenue from economic activities – other costs of economic activities + depreciation.

The UiD signal shall be assessed if the result is less than 1.0. Example:

| Not UiD | Not UiD | UiD | UiD | |

| Total equity | 45 000 | 45 000 | 45 000 | -5 000 |

| Total creditors | 100 000 | 337 500 | 400 000 | 50 000 |

| CALCULATION FOR THE FIRST CONDITION: | ||||

| Total creditors / Total equity | 2,2 | 7,5 | 8,9 | -10,0 |

| EBITDA | 15 000 | 15 000 | 15 000 | -15 000 |

| Interest payments and similar costs | 5 000 | 15 000 | 20 000 | 5 000 |

| CALCULATION FOR THE SECOND CONDITION: | ||||

| EBITDA / Interest payments and similar costs | 3,0 | 1,0 | 0,8 | -3,0 |

Indicators are checked for each of the last two financial years separately, but the fourth sign of a UiD only appears when both defined conditions are present for the last two years at the same time.

To assess the third and fourth sign of a UiD for a group of linked companies, data of the group’s consolidated accounts is used. When the consolidated accounts are not prepared according to the requirements of regulatory enactments, the necessary numbers for calculations are aggregated from the individual annual report of each linked company.

Who should assess what UiD signals?

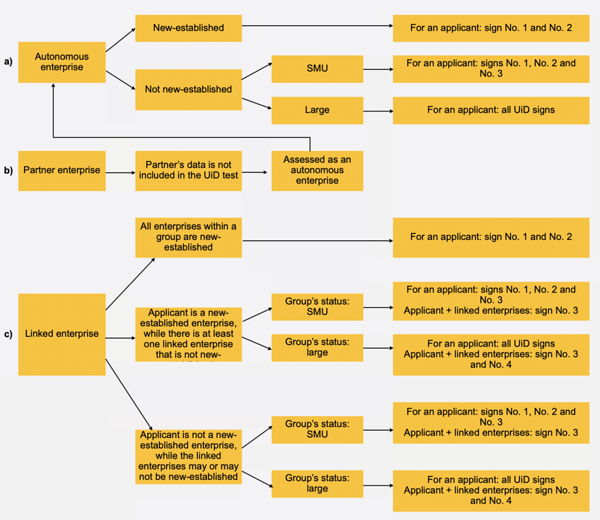

When required by laws and regulations of the Cabinet and European Commission for some specific aid program, the UiD test is mandatory but the criteria for who should assess what signs and at which moment may vary. Generally, the UiD test includes data of both the applicant and all it linked companies (if the applicant is not an autonomous enterprise), but also the age of companies and their category (SMU or large enterprise) is considered.

It should be admitted that identification of the linked companies is a separate and rather complicated subject, which we will not discuss now but the informative material provided by the CFCA gives a good explanation of that.

In order to understand what UiD conditions for what companies must be assessed, three things should be identified first:

- Is the applicant an autonomous, partner, or linked enterprise?

- Is the applicant a newly established enterprise (registered with the Register of Enterprises of the Republic of Latvia for less than three years by the time aid is granted)? Can the linked companies (should there be such) be classified as newly established ones?

- Is the company a SMU or a large enterprise?

First, the UiD test shall be performed for the applicant individually. If an applicant has linked companies, the UiD test is also performed for the group of linked enterprises, by also including the data of the applicant. Data of partner enterprises is not included in the UiD test.

Overall, the following UiD testing combinations are possible:

In what cases is aid refused?

Aid is not granted if the applicant is an autonomous enterprise (meaning there are no linked companies) with UiD signs. So far so clear. But what to do if the applicant has linked undertakings and the assessment shows different results for the applicant individually and the group of linked enterprises?

An applicant and / or a group of linked companies can show the following UiD result combinations implying the following decisions:

| An individual applicant | A group of linked companies, where the data of an applicant is included | Can the applicant apply for aid? |

| Has no signs of a UiD | Has no signs of a UiD | Yes |

| Has no signs of a UiD | Has signs of a UiD | No |

| Has signs of a UiD | Has no signs of a UiD | No |

| Has signs of a UiD | Has signs of a UiD | No |

Conclusion: If UiD conditions are identified either for an applicant and / or a group of its linked enterprises (if the applicant belongs to a group of linked undertakings), aid is refused.

Can UiD signals be prevented?

If it is concluded that, according to data of the last official financial report, the enterprise is in difficulty, can anything be done to save the situation? Yes, it is possible. Situation can be repaired, e. g. by improving the equity of the applicant and / or its linked enterprises, which can be done by either increasing the equity or, just the opposite, reducing the equity to cover the loss of previous years.

If UiD circumstances are prevented by applying the first scenario (e. g. the enterprise has substantially improved its financial performance or capitalized owners’ loans), it is always welcomed and assessed positively. Whereas an operation when a UiD signal is eliminated by reducing the equity is always assessed carefully and with caution.

In any case, if the financial situation has improved and all UiD signals are prevented, let us say, in the middle of a year which is not shown yet in the official annual report, the recognizedcompany’s operational reports approved by a sworn auditor are used.

Equity has not yet increased, but the decision regarding raising it has already been taken. Can a company apply for aid?

If the result of increasing the signed equity is avoidance of UiD signs, company can apply for aid provided that the equity is paid up within the term of six months as defined in the Commercial Law of the Republic of Latvia (Section 198, Paragraph 1, Clause 8 of the Commercial Law). In such case, information about increasing the equity (signed) must be submitted additionally, which is then assessed together with the operational financial report approved by a sworn auditor.

If the requirement regarding paying-up of equity within the term set in law is not fulfilled, aid is considered to be unlawful and the beneficiary is obligated to repay the granted State aid.

Identification of UiD signals for companies affected by the COVID-19 crisis

If aid that is granted as State support measures for companies hit by the COVID-19 crisis, the UiD signals tested can depend on the applicant’s category (micro, small, medium-sized or large enterprise). In addition, there is one significant difference: test is performed as at 31.12.2019 (which may be not the last submitted annual report). If an applicant has at least one of UiD signals as at 31.12.2019 and if data has not improved from 01.01.2020 until 30.06.2021 and the UiD conditions are not eliminated, the company is recognized as an undertaking in difficulty, which means that it cannot apply for aid.

Criteria for assessing applications and projects always depend on the aid program, including when the viability of the applicant is analyzed and when the planned project is assessed. However, it is important to remember that, first and foremost, UiD signals play a critical role for businesses themselves as any of these signs can suggest an unhealthy financial situation to any potential creditor, bank, supplier, investor, etc. In the event any of UiD signals set in, company’s success and viability, including its sustainable development, can be doubted.